T-kash Agents

Start your entrepreneurial journey and reap the benefits of being a T-kash Agent

T-kash Agents

This is a business appointed by Telkom to offer T-kash services to customers.

- Customer deposits

- Customer withdrawals

- New customer registration

- Sell airtime

- Sell bundles

- Sell and buy float for or from other T-Kash agents

- Customer education_ KYC, currency, money laundering, compliance

Types of Agents

- Head Office_ The function of the head office is to manage its hierarchy and ensure they have sufficient float at all times. The head office has access to T-Kash system that they use to monitor operations within their hierarchy. The head office may use the Head office till for float redistributions amount other functionalities.

- Owned Store_ the store belongs/owned by the T-kash Head office, 100% commissions goes to the head office.

- Aggregated store_ it is an outlet, which is, uses the head office, company name to trade. Commission split is 80/20 between the head office and sub agent. The sub agent owns it independently.

- Super-Agent_ T-Kash outlet that majors in selling and buying float from or to other T-Kash agents.

Categories of Agents

- Standalone_ Includes banks, hospitals, supermarkets, hotels, buildings, exchange bureau etc. that do not necessarily require several branches but operate only one outlet (branch)

- Special Agents_ these are outlets that will be approved from time to time. Pointers will include and is not limited to remote locations, temporary agents for special purpose, unique operations and a minimum of one outlet.

- Telkom Partners_ These are organizations that are already doing business with Telkom especially on SIM Card and Airtime sale.

- Non Telkom Kenya Partner_ These are organization’s that would wish have T-Kash business but are currently not working with Telkom.

- Sacco_ are non-profit financial cooperatives owned by their members and governed by a member-elected board of directors and would wish to have T-kash business in their branches.

Requirements

- Mandatory documents

- Permanent Structure (outlets)

- Float Structure

- Staff_ to do all administrative operations

Standard requirements

- Certificate of incorporation for limited companies, certificate of registration for Sole Proprietor or Partnership deed for Partners.

- Letter from the bank or canceled cheque

- Business should have been in operation for at least 6 months.

- Agent should have at least 3 shops that are ready to offer Telkom Mobile Money services.

- Minimum float of at least Ksh.50,000 for the agency head office.

- Sub agent float minimum 5,000.

- CR12 Form current to 3 months.

Requirements for Telkom Partners

- Completed TK Cash agent application forms.

- Certificate of incorporation or certificate of registration.

- A Valid CR12 Form or an equivalent document showing the list of directors (last 3 months validity).

- Copies of I.D.s for the administration officers and agent assistants as indicated in the application forms.

Non-Telkom Kenya Partner Requirements

- Certificate of incorporation or equivalent.

- Form CR12 or an equivalent form, should be valid for the last 3 months.

- Copies of I.D.s and passport photos of directors or persons playing an equivalent role.

- Copy of VAT and/or PIN certificate where applicable.

- Copy of Memorandum and Articles of association.

- List of the outlets,

- Copies of I.D.s of office administrators and agent assistants, as appearing in application forms.

- Completed Telkom Mobile Money agent application forms.

- Business Permits for each of the outlets.

- Letter from the bank or canceled cheque.

- Completed board resolution or personal declaration forms by directors or persons in equivalent roles.

- Certificate of good conduct for directors.

SACCO Requirements

- Certificate of registration

- Form CR 14/Annual returns to the Commission of Co-operatives.

- By Laws

- PIN Certificate for SACCO

- Brief profile of SACCO

- List of branches

- Copies of passport photos of executive committee members.

- Copies of I.D.s of office administrators and primary assistants as indicated in the application forms.

- Completed Telkom Mobile Money Agent Application forms.

- Business permits of the Head Office and each of the outlets.

- Completed personal declaration forms of the executive committee members.

- Certificate of good conduct of executive committee members.

- Introduction letter from Registrar of cooperatives, district/provincial registrar, with the names of the Executive Officer valid for the last 3 months.

- Duly filled Telkom Mobile Money contract.

- Letter from the bank or canceled cheque.

Sub-Agent requirements

Mandatory Documentations

- Valid Business permit.

- Copies of I.D. of owner and/or administrator.

Trade Developer Representative(s) (TDR) will be responsible for branding and training T-Kash agents. Training will include-

- T-Kash Services, products and functionalities

- Anti-money laundering (AML), Currency and Compliance

- Customer care, grooming and business tariff (Agent & customer)

- Float Management and Value addition services (profit story)

- Branding, name panels and POSM placements

Frequently Asked Questions-Tkash Agent

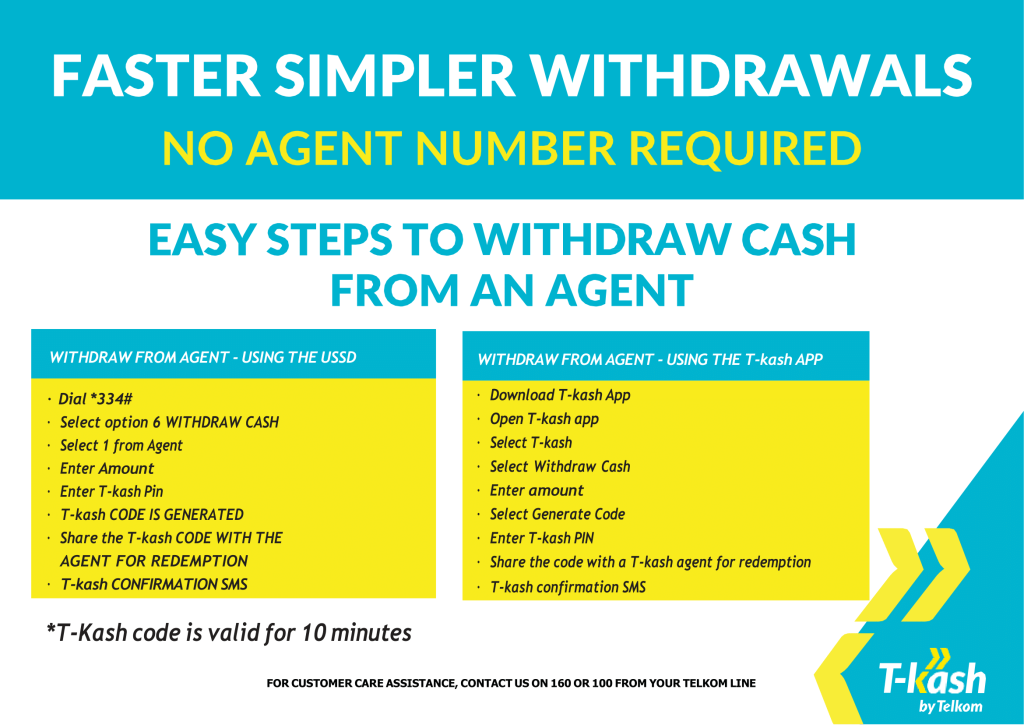

This is a One-Time 8-digit code that you use to withdraw money from an Agent or an ATM and buy goods and services. The code is validity is 10 minutes.

- The T-kash Code can be used at any T-kash Agent outlet.

- Agent number is not required to transact.

- You do not need a Till number when buying goods and services.

- It is free to generate a T-kash Code.

- If an Agent has insufficient funds and you have already generated the T-kash Code, you can visit another T-kash Agent to redeem the same T-kash Code within 10 minutes.

- Using the T-kash Code can reduce the amount of time taken at the Cashier Point when buying goods and services.

- The T-kash Code is unique and secure and can only be used once.

- You can generate a T-kash Code for someone else to use to buy goods and services.

Currently Agents earn a commission on registration, deposits and withdrawals. T-kash will inform you officially in writing of the commission policies of new products when they launch.

By the 10th of the month.

Once a month by the 10th your commissions will be deposited into your float account, your float account is the same account used to facilitate customer deposits and withdrawals.

- The Primary Assistant can view cumulative commissions until last business day using the “Account Menu” on the Till.

- You can call your Head Office admin for a copy of your commission report.

- Alternatively you can call Customer Care to ask for an email copy of your commission report.

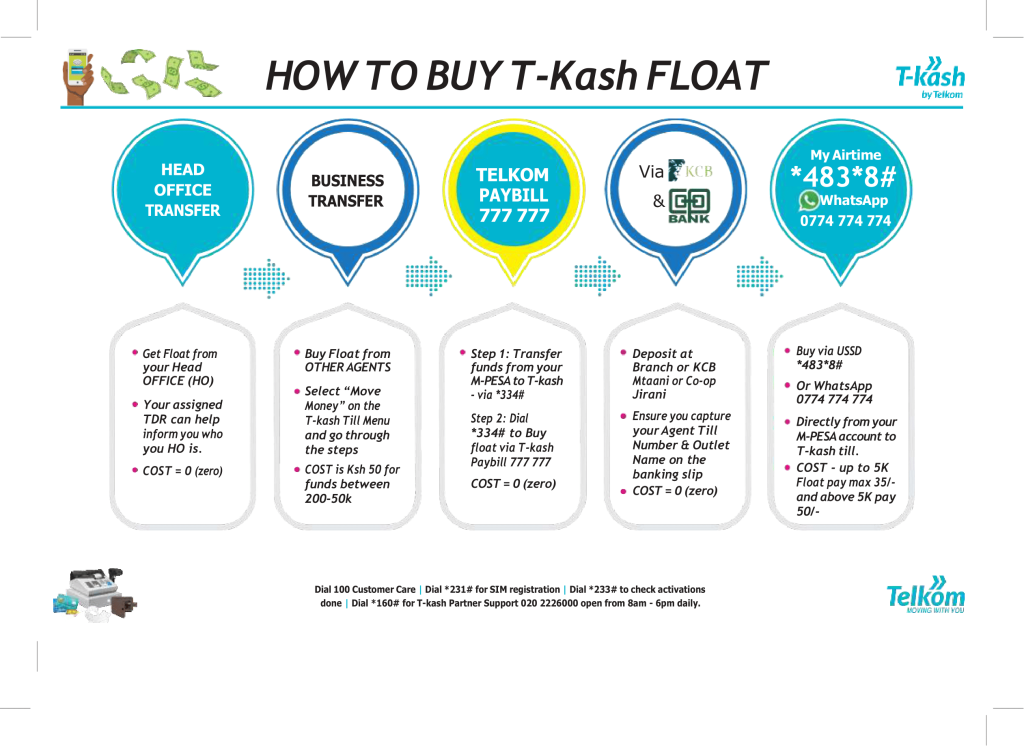

1. Agent Withdrawals.

2. ATM Withdrawals.

3. Move to Bank.

4. Float purchases from a Super-Agent.

a. Opportunity to earn money.

b. Promotional material.

c. Agent support and training.

If the network and account are okay and depending on your bank, it should take 24 hours or less.

If the network and account are okay, it should work immediately.

No. you can only have one Primary Assistant.

Call 140/160 from your T-kash Agent line.

1. The T-kash Customer Care helpline is 160.

2. The T-kash Agent helpline is 140.

Channels available

1. Contact your T-kash contact person.

2. Call Customer Care 160.

3. Contact the sales team (Zonal Manager or Trade Development Representative)

- You need a T-kash Agent enabled SIM.

- A GSM enabled phone to act as Till.

Original copies of:

1. National ID.

2. Valid Passport.

3. Alien ID.

This refers to a business appointed by Telkom to offer T-kash services to customers.

1. Register customers for T-kash.

2. Facilitate cash deposits for customers.

3. Process cash withdrawals for customers.

4. Educate customers on compliance and how to use the service.

5. Sell Telkom airtime.

6. Sell bundles

7. Sell and buy float to other agents

8. Act as the first point of contact for customers.

Anyone who has attained the minimum age of 18 years and has a national identification document is eligible to register on T-kash.

This forms part of your Agent contract and any amendments to it will be communicated in writing.

Please contact your Agency Head Office contact person to request for a SIM swap